For years, beef producers and consumers alike could see the famous Checkoff-funded Beef. It’s What’s For Dinner. advertisements across their television screens. Now, for the first time since 2003, iconic Beef. It’s What’s For Dinner. advertisements are returning to broadcast television for the holiday season. In addition to the TV advertisements, a fully integrated marketing campaign executed by the National Cattlemen’s Beef Association (NCBA), a contractor to the Beef Checkoff, will feature social media, retail e-commerce, influencer platforms, traditional media and more to promote beef as the protein of choice this holiday season. Here are five ways the Beef Checkoff is highlighting beef over the holidays.

Launched during the Hallmark Channel’s Countdown to Christmas, the famous Beef. It’s What’s For Dinner. Drool Log was the main attraction during the commercials, which began running the week of November 16 and are ending on December 26. During this period, the Beef. It’s What’s For Dinner. commercials are scheduled to run in more than 50 showings. The Checkoff-funded spots aired during highly popular timeframes, including movie “premiere” showings, the ever-popular “Thanksgiving Day Marathon” and the highly coveted “Countdown to Christmas” weekend spotlight.

Additionally, NCBA created new videos for the holiday season to promote through all social media platforms and digital channels. Here are some of the Beef Checkoff’s holiday videos:

To extend beef messaging over the holidays, Beef. It’s What’s For Dinner. partnered with Buzzfeed, a large content creator with Tasty Food Recipes and Videos, a segment within that brand. The Checkoff partnership with Tasty creator and beef lover Alvin Zhou resulted in a beef video demonstration, a live Buzzfeed Q&A, two custom beef articles and social media posts on the Buzzfeed channel. The goal was to gain 1.75 million video views and seven million impressions.

To reach more of the Beef Checkoff’s consumer target audience – 25-44 millennial-aged parents – Beef. It’s What’s For Dinner. is airing audio ads through the popular music streaming app, Spotify. Spotify serves beef’s audio ads while the audience listens to holiday playlists, making the beef holiday-specific ads contextually relevant. It’s estimated that this effort garnered 4.5 million impressions.

A partnership with Gallo Wines showed how beef and wine are the perfect holiday pairing. Gallo wines presented a holiday offer for $15 back when a consumer buys a prime rib and two bottles of Louis M Martini wine. This partnership is available both in-store and online through retailers. Promoting this holiday offer will increase beef retails sales for December.

Target is marketing direct to consumers and focusing heavily on fresh products. Because of increased traffic for ordering online, Beef. It’s What’s For Dinner. saw an opportunity to leverage beef messaging and have a shopping call to action for beef products through Target’s digital media offerings, like their Target app and Target.com.

The Beef Checkoff’s efforts to position prepared beef as a nutritious option for any lifestyle.

“Processed” or “prepared” – both words describe ready-to-eat or ready-to-cook meats like hot dogs, beef jerky, deli meats and more, but which term sounds more appealing and resonates more positively with consumers?

According to research conducted by the North American Meat Institute (NAMI), a contractor to the Beef Checkoff, “prepared” is by far the winning synonym. Consumers have a positive association with prepared meats, and 78 percent of those surveyed specifically say they would be more likely to purchase prepared meats over processed meats, and 71 percent say prepared meats are more healthful than processed meats.

This research was key for NAMI to determine the proper course of action to promote and strengthen prepared beef’s benefits. Numerous studies and the Dietary Guidelines for Americans affirm that prepared beef can be part of a healthy, balanced diet. These products provide consumers with a convenient and balanced dietary source of proteins, vitamins and minerals.

Through influencer relations, entertaining promotional campaigns and product innovation, NAMI advances prepared beef and changes the way consumers talk about these products.

In further prepared beef nutrition research, FMPRE has a number of priorities. First, it wants to establish a risk-benefit analysis on the consumption of further processed beef as a component of a healthy lifestyle. FMPRE will also prepare comprehensive white papers to assess what is currently known about processed beef consumption and identify any potential data gaps on the mechanistic development of cancer in humans for processed beef components. Finally, the foundation will conduct menu modeling that demonstrates the role of further processed beef in the healthy dietary patterns identified in the 2020 to 2025 Dietary Guidelines.

One specific FMPRE white paper, A Guide to Meat Processing for the Nutrition Community, serves as a guide for nutrition experts and the scientific community. This white paper assesses how meat is processed, common categories of processed meats and their characteristics, the meaning of different labeling claims and an overview of the nutritional benefits of meat consumption and public health implications.

In fiscal year 2021, FMPRE is soliciting and reviewing at least 15 different technical proposals on beef research. The foundation can directly apply research outcomes to help create a safer product and demonstrate how prepared products are safe, nutritious and fit in a healthy diet. Learn more about FMPRE’s research efforts here.

Whether it be communicating to consumers or the scientific community, the Beef Checkoff’s prepared beef research and promotion help position beef as a whole, the number one protein of choice.

Prime rib, ribeye, brisket and tenderloin – all popular, high-value beef cuts Americans naturally reach for. But what about those cuts that don’t fit into the typical taste preferences of consumers in the U.S. – what happens to them?

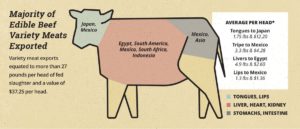

There’s very minimal demand for beef variety meats like tongue, lips, liver, heart, kidney, stomach and intestine here in the U.S. Still, across the world, international consumers are eager to get their hands on these U.S. beef products – and they’re willing to pay a premium for them.

To get those premium prices, the U.S. Meat Export Federation (USMEF), a contractor to the Beef Checkoff, creates and shares innovative ways to serve and eat U.S. variety meats, then markets those meats to the proper audiences across the world. Because of their efforts, the U.S. is the world’s largest exporter of edible beef variety meat.

USMEF works to capitalize on international taste preferences and add value back per head for the U.S. producer. For example, beef tripe, the lining of a cow’s stomach, while not particularly popular in the U.S., is commonly used to flavor soups like Menudo in Mexico. U.S. tripe exports to Mexico equated to $4.28 per head of fed cattle slaughter in 2019 and reached more than $111.7 million in revenue. This was up 30 percent from 2018 1.

In Japan, the dominant destination for U.S. beef tongue, a major beef bowl restaurant chain, Yoshinoya, recently launched its first-ever dish featuring U.S. beef tongue at a price of about $8. Growing demand for this product in Japan contributed to 2019 exports of U.S. beef tongue, equating to $12.20 per head of fed slaughter2.

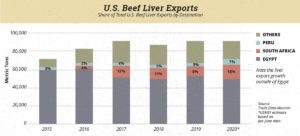

USMEF also works to expand these products into a wider range of markets. In recent years, U.S. beef liver exports have become more diversified. Egypt has long been the leading destination for U.S. beef livers, but liver exports have relied less on Egypt as demand for the product in Sub-Saharan Africa, Latin America and Asia has grown. USMEF executes campaigns that help elevate the growing popularity of this product in these markets.

For example, in Peru, USMEF launched an initiative to promote the benefits of U.S. beef liver in helping combat anemia. This project included medical students greeting consumers in butcher shops and supermarkets to share information about healthy eating habits and how consuming beef liver increases iron intake. The motivation for this campaign came from a Peruvian Health Ministry report that revealed anemia cases in Peru have risen in recent years due to iron-deficient diets, with the country’s national anemia rate in children at a startling 47 percent. This campaign was a massive success. Arisa, a distributor that deals mostly with wet markets in Lima, Peru, experienced a 23 percent increase in U.S. beef liver sales during the promotion. Grupesac, a retailer with two outlets where U.S. beef liver accounts for 60 percent of total sales, saw a 22 percent increase3. This campaign is just one example of how USMEF is boosting U.S. beef liver consumption in international markets.

For example, in Peru, USMEF launched an initiative to promote the benefits of U.S. beef liver in helping combat anemia. This project included medical students greeting consumers in butcher shops and supermarkets to share information about healthy eating habits and how consuming beef liver increases iron intake. The motivation for this campaign came from a Peruvian Health Ministry report that revealed anemia cases in Peru have risen in recent years due to iron-deficient diets, with the country’s national anemia rate in children at a startling 47 percent. This campaign was a massive success. Arisa, a distributor that deals mostly with wet markets in Lima, Peru, experienced a 23 percent increase in U.S. beef liver sales during the promotion. Grupesac, a retailer with two outlets where U.S. beef liver accounts for 60 percent of total sales, saw a 22 percent increase3. This campaign is just one example of how USMEF is boosting U.S. beef liver consumption in international markets.

All of these specialized campaigns, like the U.S. beef liver campaign in Peru, are funded by the Beef Checkoff and executed by USMEF staff members worldwide. At USMEF’s 16 international offices, local staff, who live their day-to-day lives in these specific countries, are already integrated into the national culture and help strategize and execute campaigns that fit their country’s needs and preferences. By understanding the language, food preferences and shopping habits, these local team members allow a “boots-on-the-ground” approach. This helps USMEF be relevant and efficient when marketing U.S. variety meats to global consumers.

Adding Value Back to Producers

Adding Value Back to ProducersThese efforts to promote U.S. variety meats ultimately do contribute to producer success here at home. The Beef Checkoff meets the desires of consumers across the world by providing them with the beef cuts and products they most want to purchase. In turn, global competition for these cuts contributes to producers getting the best prices possible and boosts demand for cattle. In 2019, U.S. variety meat exports contributed to more than 27 pounds per head of fed slaughter. This resulted in a per-fed-head value of $37.27 4.

With strong, effective programs and other efforts in place to grow worldwide U.S. variety meat demand, the Beef Checkoff is contributing to the advancement and strength of the industry, both here and abroad.

There seems to be a rash of articles and news pieces in ag media lately, focused on beef demand and its driving power and importance in everything from cattle prices to grocery store sales. The writers and experts all agree on this: the process of generating beef demand is like a well-primed pump. It provides the beef industry with the means to push our great product into the hands of hungry consumers the world over.

One of these articles summarized recent webinar information and data from Dr. Ted Schroeder and Dr. Glynn Tonsor, two leading agricultural economists at Kansas State University. The article starts with a key statement from Dr. Schroeder: “Prosperity of all beef industry participants hinges critically upon consumer demand. Every new dollar that enters the industry comes from the consumer. Without the consumer, we are out of business.”

He is correct, of course. Beef demand IS everything. Consumers have a vast array of protein choices. It is an extremely competitive protein market: beef, pork, chicken, meat alternatives – even products like beans and peanut butter. But how do we create demand for beef over all these other options? This is exactly what your Beef Checkoff is designed to do – create demand to make beef the first choice of consumers through promotion, research and education.

Even with the pandemic’s impact, the Beef Checkoff has been able to adapt and adjust programs to continue reaching those consumers and influencers. In many cases they have been able to increase program reach by shifting from in-person to virtual events. For example, events targeting middle and high school educators about beef – which typically have had 40 in-person attendees – are now reaching thousands online. Videos on veal production have reached nearly 11 million people since January.

A new Checkoff-funded video series, “Real Facts About Real Beef,” delivers facts directly to consumers from the source: beef farmers and ranchers, as well as credentialed experts in the fields of sustainability, human nutrition and more. This series is just one of the ways that the Beef. It’s What’s For Dinner. brand has helped debunk myths about the beef industry – by delivering the facts straight to consumers at home.

Beef demand is strong, as seen by the stats showing that beef sales lead all retail animal protein sales since the pandemic hit. Yet our competition never slows down. Our focus is to keep that strong flow of information to consumers so they will want our product even more. The Beef Checkoff provides a wellspring of beef promotion and resources, and consumers are eating it up.

Twenty cattlemen and women – representing cow/calf, feeders, stockers, dairy, and importers – will gather in Denver, Colorado on September 9 & 10 to discuss, debate, and ultimately allocate around $40 million for eligible beef industry programs within the Beef Checkoff. This group is known as the Beef Promotion Operating Committee (BPOC) and meets each year at this time with some big beef decisions on their plate.

The BPOC “September Decision” is no easy task. The Committee is appointed by their peers, and has 10 members from the Cattlemen’s Beef Board, and 10 members from the Federation of State Beef Councils, from all over the U.S. This versatile group is tasked with a very important and serious job: to select and fund the best Beef Checkoff programs for the following fiscal year, beginning October 1.

Months of feedback has already taken place by the time the BPOC members step off the plane in Denver. Calls for proposals from Checkoff contractors went out earlier in the year; the proposals, known as Authorization Requests (ARs), were reviewed and edited by multiple bodies. In July, contractors presented their preliminary ARs to more than 200 beef producers on Checkoff committees, asking for honest feedback and comments on their ideas and projects. Those committees obliged and gave them pages of comments and suggestions, and even rated every potential program. Following those presentations, each contractor then took that feedback home and adjusted their projects to best ensure they meet the needs and wants of those producers that pay into the Checkoff. That same feedback was gathered and handed over to the BPOC for this September meeting– valuable insight when allocating millions of dollars.

Membership on the Operating Committee is not for the meek. Every year, contractors typically bring many millions of dollars more in “asks” than the budget allows. Dividing the Checkoff dollars between promotion, research and education projects – down to the penny, I might add – is often accompanied by lively debate, difficult decisions, and unfortunately, even cuts to great programs. The members weigh and sift each proposal, separating the “wheat from the chaff, by focusing on what they believe will best support the industry now and in the future.

These beef-producing decision makers pay Checkoff dollars themselves; they know the weight of their “September Decision” on fellow cattle families, and the entire beef industry. Those Checkoff dollars are theirs too, and their decisions are not taken lightly.

For more information on the upcoming 2020 Beef Promotion Operating Committee meeting, which is open to anyone and will be conducted virtually this year, click here.

On July 27-30, cattlemen and women from across the U.S. gathered at the Gaylord Rockies resort in Denver – and virtually, from their own farms and ranches – for the annual Cattle Industry Summer Business Meeting. Here, the cattle industry discussed current issues as a group, heard the new 2021-2025 Beef Industry Long Range Plan and reviewed how the Beef Checkoff has adjusted messaging and programs over the past several months.

While at the meeting, Beef Checkoff committee members from the Cattlemen’s Beef Board and Federation of State Beef Councils in each of the five different program committees – Safety, Nutrition and Health, Innovation, Consumer Trust and Export Growth – heard presentations from Checkoff contractors. These presentations explained how programs, research and education have creatively changed to drive beef demand over the past six months. A video of the full presentation can be viewed below.

“As we’re all aware, 2020 has presented the beef industry with numerous challenges,” said Jared Brackett, chair of the Cattlemen’s Beef Board. “Our Beef Checkoff contractors have truly risen to the occasion, revising their 2020 plans to accommodate the changes that the COVID-19 pandemic has brought to our lives, both professionally and personally. The presentations we heard at this year’s Summer Business Meeting only made me feel even more confident that the Checkoff will continue to drive beef demand in a positive direction. I’m also looking forward to seeing how we’re able to apply what we’ve learned in 2020 to our efforts in 2021.”

To learn more about the Beef Checkoff and its programs, including promotion, research, foreign marketing, industry information, consumer information and safety, visit DrivingDemandForBeef.com.

Jared Brackett

Cattle prices have plummeted in recent weeks due to supply chain disruptions from the coronavirus pandemic. Despite the current challenges, Cattlemen’s Beef Board Chair Jared Brackett says the checkoff program continues to drive demand for beef. The mandatory Beef Checkoff is $1 per head collected each time cattle are sold. Brackett, who is a cow/calf producer and cattle feeder in southern Idaho, says it is bothersome when prices are not profitable. “It does bother me when I get $1.09 for a pen of cattle I trade three weeks ago that graded 42 percent prime and 58 percent choice,” says Brackett. “That’s $20 under what I got last year at this time. I tell my fellow producers keep doing what you do best; that’s producing safe, nutritious beef.” The full RRFN interview with Brackett is available here.

Jo Ann Smith is perhaps best known as the visionary founding chair of the Cattlemen’s Beef Promotion and Research Board, spearheading the development of the highly successful Beef Checkoff. Widely regarded as one of the most effective leaders in the organization’s history, Mrs. Smith shared a few words at the Cattlemen’s Beef Board meeting in San Antonio in February.

Cattle producers Jared Brackett, Hugh Sanburg and Norman Voyles, Jr. are the new leaders of the Cattlemen’s Beef Promotion & Research Board (CBB). Elected by their fellow CBB members during the Cattle Industry Convention in San Antonio on February 7, 2020, this officer team is responsible for guiding the national Beef Checkoff throughout 2020.

Brackett, the 2019 Vice Chair, will now serve as the CBB’s Chair, while Sanburg will transition from his role as the 2019 Secretary-Treasurer to become the 2020 Vice Chair. Voyles is the newest member of the officer team, taking on Sanburg’s former responsibilities as Secretary – Treasurer.

2020 Chairman Jared Brackett is a fifth-generation cow/calf producer from Filer, Idaho. Brackett is a Texas A & M alumni and diehard Aggie fan with a degree in agriculture economics. A past president of the Idaho Cattlemen’s Association, Brackett continues to serve on a number of other livestock committees and boards in addition to his responsibilities with the Beef Checkoff.

“The beef industry has been a part of my family’s livelihood for decades,” Brackett said. “While there’s no doubt that our industry has its own unique set of challenges, I believe that by working together, we can enact positive change that will continue to drive beef demand worldwide. During my tenure as the CBB’s Chair, I plan to collaborate with our officer team and the entire board to encourage checkoff advocacy and find new ways to move our industry forward.”

Vice Chair Hugh Sanburg hails from Eckert, Colo., where he and his brother are managing partners of their primarily horned Hereford cow-calf operation, accompanied by a Registered Hereford operation to complement the commercial herd. Sanburg graduated from Colorado School of Mines with a degree in mining engineering in 1983 before moving back to the home ranch in western Colorado. For the past 30-plus years, Sanburg has been an active member of the Colorado Farm Bureau serving on various boards. He is also a member of the Colorado Cattlemen’s Association and serves as chairman of the Gunnison Basin Roundtable.

Secretary-Treasurer Norman Voyles, Jr. owns and operates a seventh-generation grain and livestock farm near Martinsville, Ind. with his brother Jim and son Kyle. Voyles received a bachelor’s degree in animal science from Purdue University and a master’s degree in ruminant nutrition from the University of Nebraska. Voyles is a member of the Morgan County (Ind.) Beef Cattle Association and the Indiana Cattlemen’s Association. He’s a past member of the Farm Service Agency board of directors and the Morgan County Fair board.

“We’re extremely fortunate to have such a dedicated and experienced group leading the CBB throughout the coming year,” said Greg Hanes, CEO of the Cattlemen’s Beef Board. “Not only are they cattle producers themselves, but they’ve also worked diligently on the beef industry’s behalf for many years. Jared, Hugh and Norman are fully aware of the challenges producers currently face, and they have what it takes to answer those challenges while also finding new opportunities. I have no doubt their leadership will help the Beef Checkoff achieve great success in 2020.”

Beef exports and imports are certainly a challenging topic to tackle for American cattle farmers and ranchers, but are an integral part of our beef industry here in the United States.

At first glance the idea of importing foreign beef into the U.S. may strike cattlemen and women here as a curious practice. If we grow arguably the best beef in the world in this country, why bring in more? The reason lies in the types of beef we Americans love to eat – mainly steaks and ground beef. In fact, CattleFax estimates that over 51% of the beef consumed in the United States is ground beef.

Steaks are high-demand, high-value cuts and consumers are willing to pay higher prices for them. This is great because it brings more value to the cutout. But American consumers also love hamburgers, and most of those are consumed at fast food restaurants at low prices. Since American farmers and ranchers are producing more Prime and Choice-graded beef these days, the value of the non-steak cuts, due to global demand, are higher than the value of hamburger. So rather than grind them into burgers, we can export them for a premium.

However, in order to meet that domestic demand for inexpensive fast food hamburgers we need to import beef. Despite what you might visualize imported beef to be, most of the beef we bring into the U.S. is lean trim, not muscle cuts for sale at retail. In conversations I’ve had with industry experts, most estimate that at least 90% of our imports are inexpensive lean trim or manufacturing beef that is then ground with fat (something we produce but consumers don’t buy outright) from our corn-fed animals to produce all those fast food hamburgers at cheap prices for hungry American consumers.

At the same time, we export other beef cuts (which could have been ground) and variety meats (which we don’t like to eat here) to other markets around the world. Those markets have a high demand for those cuts, so we can then receive top dollar back for those items. For example, short plate could be ground and get about $1.50 per pound here, but as a high demand item in Japan, they will pay double that price per pound. Assuming each short plate weighs 15 pounds, USMEF estimates that one item is adding about $22.50 per head of value. Tongues are another great example. No one I know around here grills them up on the weekend! Demand for those are low, only fetching about $1.00 per pound here in the United States. But in Japan, every person I know loves to grill tongue, so they pay more than $5.50/pound there. That adds another $13.00 per head.

This happens with other cuts in other countries as well, helping to add value – especially to low demand items in the U.S.According to CattleFax, the amount of beef we imported compared to the amount of beef we exported last year is expected to be about the same (final 2019 figures will be released in February).However, and this is very key, the value of our exported beef is estimated to be about $1.3 billion higher.

In a nutshell, we are meeting the desires of consumers with the beef they want to purchase, wherever they are in the world. The global competition for these cuts helps us get the best prices possible and boosts demand for our cattle.

Next time we’ll discuss the role the Beef Checkoff plays in imports and exports.

Recently, Burger King, the second-largest burger chain in the U.S., announced it would begin serving another version of the iconic Whopper using an all-vegetarian patty. Burger King’s adoption of this plant-based, alternative patty is a big move in the primarily beef-focused foodservice arena, providing consumers greater access to alternative proteins. What does this mean for the beef industry?

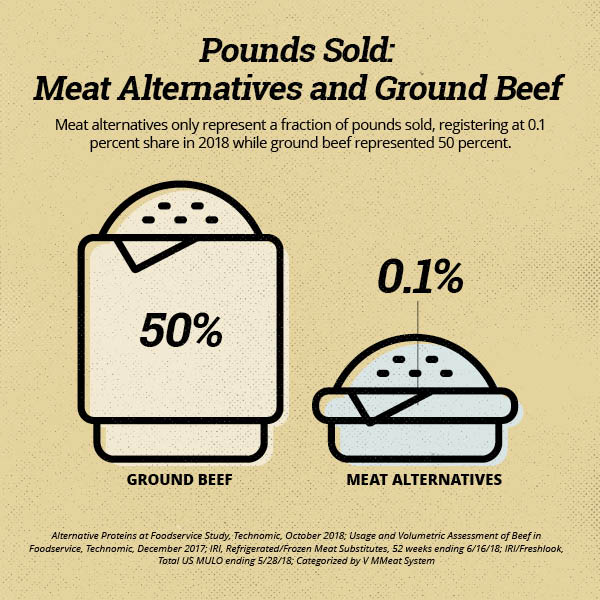

Well, Americans love beef, especially burgers. It’s a fact. Americans consume roughly 50 billion burgers a year, with the average American eating three hamburgers a week1. There is even a national day dedicated to the love of the hamburger. National Burger Day, a day of appreciation for hamburgers, fell on May 28th this year. In 2018, ground beef accounted for 40 percent of dollar sales and half of last year’s pound sales2. All of these facts confirm that beef is what consumers continue to love, buy and eat.

Still, more and more restaurants and stores are offering plant-based alternative proteins to give their consumers greater variety on their menus and their shelves. Many restaurants and food service businesses that have latched onto this trend. While the trend is still growing, it is important to note that meat alternatives only represent a fraction of pounds sold, registering at 0.1 percent share in 20183.

The main selling points for companies producing plant-based, alternative proteins revolve around the environment, nutrition and animal welfare. They contend plant-based proteins require fewer natural resources, including water and land, and emit fewer greenhouse gases when compared to the beef production system. Another view is based upon the common misconception that red meat is bad for the human diet. Lastly, these companies use emotional tactics to tell consumers that, by opting to eat plant-based proteins, they can keep animals from being slaughtered and consumed.

These selling points may attract a certain type of consumer. However, the Beef Checkoff has taken significant measures to bring beef to the consumer forefront and position it as one of the world’s most desirable proteins.

When it comes to sustainable production processes, the beef industry has moved forward in leaps and bounds. Producers are constantly looking for new ways to produce more beef with fewer resources. In fact, today, U.S. beef farmers and ranchers are able to produce the same amount of beef with one-third fewer cattle than they did in 19774. The checkoff-funded lifecycle assessment gives consumers and the industry a clear picture as to what beef sustainability looks like today.

When it comes to health, the Beef Checkoff works with dietitians and physicians regularly to educate them on the health benefits of including beef in an everyday diet. The checkoff-funded Beef. It’s What’s For Dinner. brand serves as the consumer-facing resource dedicated to educating individuals through webinars, seminars, fact sheets, cooking lessons, nutrition research and more on the ways lean beef contributes to a healthy lifestyle. Research shows that consumers consider beef one of the best sources of protein5.

Ironically, meat eaters are the target audience for many of the companies promoting plant-based, alternative proteins. Their campaigns have centered around their products’ amazing similarity, texture and taste compared to beef. On April Fools’ Day, Burger King “fooled” some beef-loving restaurant goers into thinking they were eating the Whopper’s original beef patty when they were actually eating the newly introduced plant-based patty instead. The reaction was overwhelming, with many saying they couldn’t believe how alike the two options tasted.

“Beef has one ingredient—beef. While plant-based alternatives, consisting of dozens of ingredients, have demonstrated similarities to beef, it’s important that consumers understand exactly what they’re eating and where it came from,” states Janna Stubbs, Cattlemen’s Beef Board member from Alpine, Texas. “The beef industry has worked hard to be transparent and give consumers the high-quality beef they seek and trust to feed their families.”

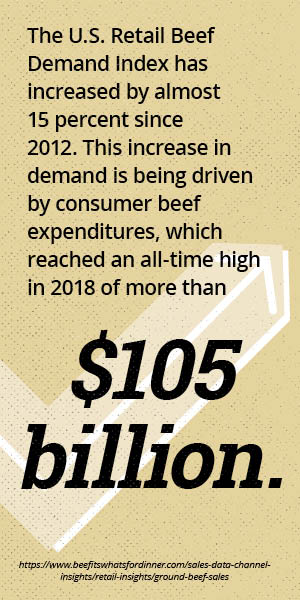

The Beef Checkoff has dedicated valuable resources toward consumer and market research to determine how consumers think about beef and alternative proteins, as well as where they are spending their protein dollars. In 2019, annual projected beef consumption is more than 58 pounds per capita versus beef substitutes measuring in at a few ounces per capita6. Furthermore, the U.S. Retail Beef Demand Index has increased by almost 15 percent since 2012. This increase in demand is being driven by consumer beef expenditures, which reached an all-time high in 2018 of more than $105 billion7.

Consumer marketing is also a big priority. For consumers to continue buying beef, the Beef Checkoff must invest in initiatives that increase beef’s visibility and appeal. The Beef. It’s What’s For Dinner. brand has created a series of social media ads that clearly position beef as one of the top proteins and address meat alternatives head on.

The Beef Checkoff also targets consumers who are actively searching for information on topics like beef sustainability—effectively disputing the claims made by companies producing plant-based alternatives—and driving them toward the Beef. It’s What’s For Dinner. website for accurate information.

The Beef Checkoff works to leverage resources in the most impactful areas so producers can be confident that consumers are purchasing their superior products. Listening to consumers and adapting to their purchasing decisions are key to the beef industry’s success. Much is still on the horizon when it comes to alternative proteins, but the Beef Checkoff will continue to identify ways to position beef as the number one protein choice amongst consumers and drive demand for beef.